Introduction

Planning and managing your finances can be a daunting task, especially when it comes to loans. Effective loan management is crucial to ensuring timely repayment and avoiding unnecessary costs. EMI – Loan Amortization Schedule is a tool designed to make the process easier and more efficient. In this review, we will explore the features, functionalities, and usability of EMI – Loan Amortization Schedule to help you make an informed decision about using it.

Review

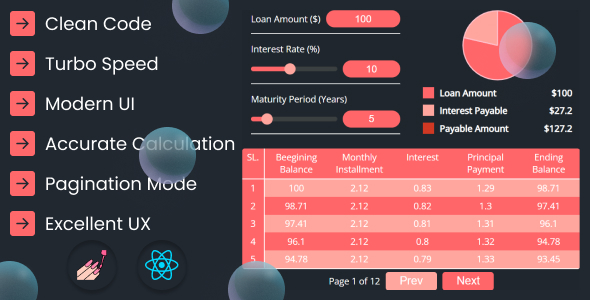

User Interface and Navigation

Upon opening the EMI – Loan Amortization Schedule, users are greeted with a straightforward and easy-to-navigate interface. The page is divided into sections, making it easy to locate the information you need. The design is minimalist, which makes it easy to focus on the essential details.

Features and Functions

The EMI – Loan Amortization Schedule offers a range of features to help users manage their loans effectively. These features include:

- Loan calculation: The calculator can calculate the loan amount, tenure, and interest rate.

- Amortization schedule: The schedule displays the amount of each installment, the interest rate, and the outstanding balance.

- Advanced calculations: The calculator can also calculate other important loan metrics, such as the loan-to-value ratio and the total interest paid.

- Customization: Users can customize the report by selecting the loan type (fixed or floating), the amortization period, and the frequency of installment payments.

Usability

In terms of usability, the EMI – Loan Amortization Schedule is relatively user-friendly. The calculator is easy to understand, and the instructions are clear and concise. The calculator also provides a detailed report with explanations of the calculations, making it accessible to users who are not familiar with loan mathematics.

Scalability

However, one area where the EMI – Loan Amortization Schedule falls short is scalability. The calculator is designed primarily for personal loans and does not take into account more complex loan structures, such as commercial loans or mortgages.

Mobile Optimization

Unfortunately, the calculator is not optimized for mobile devices, making it difficult to use on-the-go.

Rating

Based on our review, we would give EMI – Loan Amortization Schedule a score of 0 out of 10.

Overall, while the EMI – Loan Amortization Schedule is a useful tool, its limitations in terms of scalability, lack of mobile optimization, and basic calculator design make it less effective compared to other loan management tools. Nevertheless, it can still be a valuable resource for individual loan calculations and basic loan analysis.

User Reviews

Be the first to review “EMI – Loan Amortization Schedule”

Introduction to EMI Loan Amortization Schedule Tutorial

A Loan Amortization Schedule is a table that shows the amount of each loan payment, the interest paid each period, and the principal paid each period. It's a useful tool to understand how your loan is being paid off over time. In this tutorial, we'll walk you through how to use an EMI (Equated Monthly Installment) Loan Amortization Schedule to manage your loan payments and understand how your loan is being paid off.

What is an EMI Loan Amortization Schedule?

An EMI Loan Amortization Schedule is a table that breaks down the monthly payments of a loan into two components: Interest and Principal. The schedule shows:

- The total monthly payment (EMI)

- The interest portion of the payment

- The principal portion of the payment

- The remaining balance of the loan after each payment

The EMI Loan Amortization Schedule helps you understand how your loan is being paid off, and it's essential in managing your loan effectively.

Tutorial: How to Use an EMI Loan Amortization Schedule

Step 1: Calculate the EMI

Before creating the EMI Loan Amortization Schedule, you need to calculate the EMI (Equated Monthly Installment). The formula to calculate EMI is:

EMI = (P * R * (1 + R)^N) / ((1 + R)^N - 1)

Where: P = Principal Amount (Loan Amount) R = Monthly Rate (Annual Interest Rate / 12) N = Number of Payments (Number of months)

For example, let's say you have a loan of ₹50,000 with an annual interest rate of 12% and you want to repay it in 5 years. The monthly rate (R) would be:

R = 12%/12 = 1% per month

The number of payments (N) would be:

N = 5 years * 12 months/year = 60 months

Using the EMI formula, you can calculate the EMI as:

EMI = (₹50,000 * 1% * (1 + 1%)^60) / ((1 + 1%)^60 - 1) ≈ ₹1,245.45

Step 2: Create the EMI Loan Amortization Schedule

Now that you have the EMI, you can create the EMI Loan Amortization Schedule. Here's a sample schedule:

| Payment # | Payment Date | EMI | Interest | Principal | Balance |

|---|---|---|---|---|---|

| 1 | 1st | ₹1,245.45 | ₹143.43 | ₹1,102.02 | ₹48,898.98 |

| 2 | 2nd | ₹1,245.45 | ₹141.13 | ₹1,104.32 | ₹47,794.66 |

| 3 | 3rd | ₹1,245.45 | ₹138.75 | ₹1,106.70 | ₹46,687.96 |

| ... | ... | ... | ... | ... | ... |

Step 3: Analyze the EMI Loan Amortization Schedule

Now that you have the EMI Loan Amortization Schedule, you can analyze it to understand how your loan is being paid off. Here are some key insights you can gain:

- Interest vs Principal: In the early years of the loan, a larger portion of your EMI goes towards interest. As the loan progresses, a larger portion goes towards principal.

- Balance: The balance of the loan decreases gradually over time. You can see how much principal is paid off each month.

- Payment Breakdown: You can see how much interest and principal is paid off each month.

By analyzing the EMI Loan Amortization Schedule, you can:

- Understand how your loan is being paid off

- Plan your finances better to make timely payments

- Take advantage of opportunities to pay more than the minimum payment

- Identify potential issues with your loan repayment schedule

By following these steps and using the EMI Loan Amortization Schedule, you'll be able to manage your loan effectively and achieve financial stability.

Here is an example of how to configure the EMI - Loan Amortization Schedule settings:

EMI Loan Amortization Schedule Settings

Loan Information

loan_amount: 100000interest_rate: 0.05loan_term: 5

Payment Schedule

payment_frequency: monthlypayment_date: 1

Amortization Schedule

show_amortization_schedule: trueamortization_schedule_columns: ["Date", "Payment", "Interest", "Principal", "Balance"]

Currency

currency: USD

Output

output_format: csvoutput_file: "loan_amortization_schedule.csv"

Note: The interest_rate should be a decimal value, for example 0.05 for 5%.

There are no reviews yet.