Signal Loans – Lending and Credit Management App for Micro Finance Business.

$49.00

233 sales

LIVE PREVIEW

Signal Loans – Lending and Credit Management App Review

Introduction

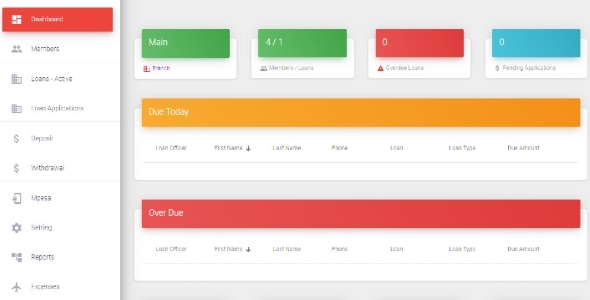

Signal Loans is a modern and user-friendly credit management system designed specifically for lending businesses. With its ease of use and robust features, this app is ideal for microfinance businesses looking to streamline their loan management processes. In this review, we’ll delve into the features, setup, and support offered by Signal Loans.

Features

Signal Loans offers a wide range of features that make it an excellent choice for lending businesses. Some of the key features include:

- Loan setup with preferred interest rates, repayment period, interest frequency, and penalties

- Multi-branch support with different roles and permissions for system users

- Inbuilt accounting with back-end double entry data capture

- Audit reports for borrowers, loans, payments, and staff performance

- Expense management in different categories at the branch level

- Loan amortization, repayments, loan applications, member registration, and user management

- Collateral management and loan account statement reports

- Roles and permissions module for secure user management

Setup and Support

The setup process is relatively easy, with accurate instructions provided by the developer. Additionally, the developer is available for support and offers clean and well-commented code for customization.

Conclusion

Signal Loans is a solid choice for lending businesses looking for a user-friendly and secure credit management system. While it may not be a full-fledged banking software, it offers a wide range of features that can help streamline loan management processes. With its easy setup and support, Signal Loans is definitely worth considering for microfinance businesses.

Score: 2.69

Recommendation

Signal Loans is a good option for lending businesses with a small to medium-sized operation. However, businesses with complex loan structures or large-scale operations may find the app’s features limiting. Overall, Signal Loans is a solid choice for those looking for a user-friendly and secure credit management system.

Contact Information

For more information or to set up a demo, you can contact the developer via WhatsApp at +254724475357.

Additional Resources

For a detailed overview of Signal Loans, you can visit their website at https://loans.robisignals.com. Username: admin@admin.com, Password: admin123.

User Reviews

Be the first to review “Signal Loans – Lending and Credit Management App for Micro Finance Business.”

Introduction to Signal Loans - Lending and Credit Management App for Micro Finance Business

Signal Loans is a comprehensive mobile app designed specifically for microfinance businesses, enabling them to manage their lending operations efficiently and effectively. The app provides a secure, user-friendly platform for loan officers to manage loan applications, track loan disbursements, and monitor loan repayments. In this tutorial, we will guide you through the features and functionality of the Signal Loans app, helping you to get started with using it for your microfinance business.

Getting Started with Signal Loans App

To begin using the Signal Loans app, follow these steps:

- Download and Install the App: Go to the Google Play Store or Apple App Store and search for "Signal Loans". Download and install the app on your mobile device.

- Create an Account: Launch the app and tap on the "Sign Up" button. Fill in the required information, including your business name, email address, and password. Verify your email address by clicking on the link sent to you by the app.

- Configure Your Business Profile: Complete your business profile by adding your business name, address, and contact information. This information will be used to identify your business and generate loan documents.

Main Features of the Signal Loans App

The Signal Loans app offers a range of features to help you manage your lending operations efficiently. The main features include:

- Loan Application Management: The app allows loan officers to receive and manage loan applications from borrowers. You can view application details, including loan amount, interest rate, and repayment terms.

- Loan Disbursement: The app enables you to disburse loans to borrowers, with options to set disbursement dates and amounts.

- Loan Repayment Tracking: The app allows you to track loan repayments, including payment dates, amounts, and interest accrued.

- Loan Portfolio Management: The app provides a comprehensive view of your loan portfolio, enabling you to track loan performance, including delinquencies and defaults.

- Customer Management: The app allows you to manage borrower information, including contact details, loan history, and repayment records.

- Reporting and Analytics: The app provides real-time reporting and analytics, enabling you to track key performance indicators (KPIs) and make data-driven decisions.

Using the Signal Loans App for Micro Finance Business

Now that you have an overview of the app's features, let's dive deeper into how to use it for your microfinance business.

Step 1: Receiving and Managing Loan Applications

- Tap on the "Loan Applications" tab to view a list of loan applications received by your business.

- Tap on an application to view the borrower's details, including loan amount, interest rate, and repayment terms.

- Review the application and approve or reject it as needed.

Step 2: Disbursing Loans

- Tap on the "Loan Disbursement" tab to view a list of approved loan applications.

- Tap on an application to view the borrower's details and disbursement options.

- Set the disbursement date and amount, and tap "Disburse" to release the loan.

Step 3: Tracking Loan Repayments

- Tap on the "Loan Repayments" tab to view a list of loan repayments received by your business.

- Tap on a repayment to view the borrower's repayment history, including payment dates, amounts, and interest accrued.

- Track delinquencies and defaults, and take necessary action to recover outstanding loans.

Step 4: Managing Your Loan Portfolio

- Tap on the "Loan Portfolio" tab to view a comprehensive view of your loan portfolio.

- Track loan performance, including delinquencies and defaults, and make data-driven decisions to improve your lending operations.

- Use the app's reporting and analytics features to identify trends and areas for improvement.

Conclusion

The Signal Loans app is a powerful tool for microfinance businesses, providing a secure and efficient platform for managing lending operations. By following this tutorial, you should now be able to use the app to receive and manage loan applications, disburse loans, track loan repayments, and manage your loan portfolio. Remember to regularly review and update your business profile, and to use the app's reporting and analytics features to improve your lending operations.

Here is an example of complete settings for Signal Loans - Lending and Credit Management App for Micro Finance Business:

Database Settings

The database settings for Signal Loans can be configured in the config/database.php file. The example configuration is as follows:

'default' => [

'driver' => 'mysql',

'host' => 'localhost',

'database' => 'signalloans',

'username' => 'root',

'password' => 'password',

'charset' => 'utf8',

'collation' => 'utf8_unicode_ci',

'prefix' => '',

],App Settings

The app settings for Signal Loans can be configured in the config/app.php file. The example configuration is as follows:

'locale' => 'en',

'date_format' => 'Y-m-d H:i:s',

'timezone' => 'Africa/Johannesburg',

'mail_driver' => 'smtp',

'mail_host' => 'smtp.gmail.com',

'mail_port' => 587,

'mail_username' => 'your_email@gmail.com',

'mail_password' => 'your_password',

'mail_encryption' => 'tls',

'mail_from_address' => 'your_email@gmail.com',

'mail_from_name' => 'Signal Loans',Security Settings

The security settings for Signal Loans can be configured in the config/security.php file. The example configuration is as follows:

'key' => 'base64:your_encrypted_key',

'verify_ssl' => true,

'redirect_to_ssl' => true,Payment Gateway Settings

The payment gateway settings for Signal Loans can be configured in the config/payment_gateway.php file. The example configuration is as follows:

'default_gateway' => 'stripe',

'stripe' => [

'secret_key' => 'your_stripe_secret_key',

'publishable_key' => 'your_stripe_publishable_key',

],SMS Settings

The SMS settings for Signal Loans can be configured in the config/sms.php file. The example configuration is as follows:

'default_provider' => 'twilio',

'twilio' => [

'account_sid' => 'your_twilio_account_sid',

'auth_token' => 'your_twilio_auth_token',

],Email Settings

The email settings for Signal Loans can be configured in the config/email.php file. The example configuration is as follows:

'default_driver' => 'smtp',

'smtp' => [

'host' => 'smtp.gmail.com',

'port' => 587,

'username' => 'your_email@gmail.com',

'password' => 'your_password',

'encryption' => 'tls',

],CORS Settings

The CORS settings for Signal Loans can be configured in the config/cors.php file. The example configuration is as follows:

'allowed_origins' => ['*'],

'allowed_methods' => ['GET', 'POST', 'PUT', 'DELETE'],

'allowed_headers' => ['*'],

'exposed_headers' => ['*'],

'max_age' => 31536000,Note: You should replace the placeholders (your_encrypted_key, your_stripe_secret_key, your_stripe_publishable_key, your_twilio_account_sid, your_twilio_auth_token, your_email@gmail.com, your_password) with your actual values.

Here are the features of Signal Loans - Lending and Credit Management App for Micro Finance Business:

- Multi-Loan Types: Set up different loan types with preferred interest rates, repayment period, interest frequency, and penalties.

- Branch Management: Handles different branches with different roles and permissions for system users.

- Loan Amortization: Includes loan amortization calculations and repayments.

- Loan Applications: Allows for loan applications from members.

- Member Registration: Enables member registration and management.

- User Management: Offers user management and authorization with roles and permissions.

- Collateral Management: Manages collaterals for loans.

- Loan Account Statement Reports: Generates reports on loan accounts.

- Audit Reports: Provides audit reports on borrowers, loans, payments, and staff performance.

- Expense Management: Allows for expense management at the branch level, with categories.

- OAuth 2.0 Authentication: Uses OAuth 2.0 for secure authentication.

- Angular Front-end: Utilizes Angular 8 as the front-end framework.

- REST API: Offers a RESTful API for data exchange and manipulation.

- MySQL Database: Uses MySQL as the database management system.

- Simple Accounting: Includes inbuilt accounting with back-end double entry data capture, allowing non-accounting users to use the system.

- Clean and Commented Code: Provides well-structured and commented code for customization.

Note: This list is based on the provided content and might not be exhaustive, as some features might be implicit or not explicitly mentioned.

$49.00

There are no reviews yet.