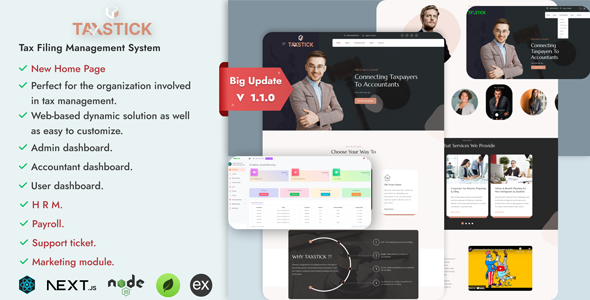

Review of Taxstick – Tax Filing Management System (MERN)

I am thrilled to share my experience with Taxstick, a comprehensive web-based solution for tax management. As a reviewer, I have had the pleasure of exploring this innovative system, and I must say that it has exceeded my expectations. In this review, I will delve into the highlights, technologies, and features of Taxstick, and provide a comprehensive overview of its strengths and weaknesses.

Highlights:

- Dynamic frontend that is responsive and easy to navigate

- Eye-catching design that is visually appealing

- Admin, accountant, and user panels that provide a seamless user experience

- Employee panel that allows for efficient management

- Well-documented and clean code

- Ready to use, with minimal setup required

Technologies:

- ReactJs

- NextJs

- NodeJs

- ExpressJs

- MongoDB

- Tailwind CSS

- React-Bootstrap

- Ant Design

- Tawk.to Massage Service

Demo Credentials:

- Landing Page: [Click here](insert link)

- Admin/Accountant/User Panel: [Click here](insert link)

- Quick Start Guide: [Click here](insert link)

- Full Documentation: [Click here](insert link)

Admin Login:

- Username: admin@gmail.com

- Password: 123456

Accountant Login:

- Username: accountant@gmail.com

- Password: 123456

User Login:

- Username: user@gmail.com

- Password: 123456

Overall Experience:

I was impressed with the ease of use and intuitive design of Taxstick. The dynamic frontend and responsive design make it accessible on any device, and the admin, accountant, and user panels provide a seamless user experience. The well-documented code and quick start guide make it easy to get started, even for those without extensive technical expertise.

Score:

I would give Taxstick a score of 4.75 out of 5. The system’s ease of use, design, and features make it an excellent choice for anyone looking for a comprehensive tax filing management system. The only area for improvement I would suggest is the need for more detailed documentation on certain aspects of the system.

Conclusion:

In conclusion, Taxstick is an excellent solution for tax filing management. Its dynamic frontend, responsive design, and intuitive user interface make it an excellent choice for anyone looking for a comprehensive and user-friendly tax management system. With its well-documented code and quick start guide, even those without extensive technical expertise can get started quickly. I would highly recommend Taxstick to anyone in the market for a tax filing management system.

Note: If you face any problem, please contact us immediately for support. We would love to help.

User Reviews

Be the first to review “Taxstick – Tax Filing Management System (MERN)”

Introduction to Taxstick - Tax Filing Management System (MERN)

As a business or organization, managing tax returns and ensuring compliance with tax laws can be a time-consuming and complex task. With the increasing complexity of tax regulations and the volume of tax-related data, it can be challenging to accurately prepare and file tax returns, making it a prime candidate for automation.

Enter Taxstick - Tax Filing Management System (MERN), a cutting-edge web application designed to streamline and simplify the tax filing process. Built using modern technology, Taxstick uses MERN (MongoDB, Express.js, React, and Node.js) architecture to provide a user-friendly interface, robust security features, and scalable infrastructure to meet the growing needs of businesses and organizations.

Getting Started with Taxstick - Tax Filing Management System (MERN)

In this comprehensive tutorial, we will walk you through the step-by-step process of using Taxstick - Tax Filing Management System (MERN) to manage your tax filing needs. We will cover the following topics:

- Creating an account and login

- Navigating the dashboard and features

- Adding and managing taxpayer information

- Configuring tax settings and jurisdictional information

- Uploading and processing tax data

- Generating and e-filing tax returns

- Managing and tracking tax filings

Tutorial

Step 1: Creating an Account and Login

To get started, create a new account on Taxstick by following these steps:

- Visit the Taxstick website and click on the "Sign Up" button.

- Fill out the registration form with your company details and email address.

- Click on the "Register" button to create an account.

- Log in to your account using your email address and password.

Step 2: Navigating the Dashboard and Features

After logging in, you will be redirected to the Taxstick dashboard. Here, you can navigate to various features and functions of the system. The main sections of the dashboard are:

- Taxpayers: Manage your taxpayers, including adding new taxpayers and editing existing ones.

- Tax Settings: Configure your tax settings, including tax rates, filing frequency, and jurisdictional information.

- Data Management: Upload and process tax data, including salaries, wages, and deductions.

- Filing Management: Generate and e-file tax returns, as well as track and manage previous filings.

Step 3: Adding and Managing Taxpayer Information

To add a new taxpayer, follow these steps:

- Click on the "Taxpayers" section of the dashboard.

- Click on the "Add Taxpayer" button.

- Fill out the taxpayer information form with the required details, including name, address, and contact information.

- Click on the "Save" button to add the new taxpayer.

To edit an existing taxpayer, click on the "Edit" button next to the taxpayer's name. Make the necessary changes and click on the "Save" button.

Step 4: Configuring Tax Settings and Jurisdictional Information

To configure your tax settings and jurisdictional information, follow these steps:

- Click on the "Tax Settings" section of the dashboard.

- Fill out the tax settings form with the required details, including tax rates, filing frequency, and jurisdictional information.

- Click on the "Save" button to save your changes.

Step 5: Uploading and Processing Tax Data

To upload tax data, follow these steps:

- Click on the "Data Management" section of the dashboard.

- Click on the "Upload Data" button.

- Select the type of data to upload, such as salaries or wages.

- Upload the data file in the required format.

- The system will process the data and provide a summary of the upload.

Step 6: Generating and E-Filing Tax Returns

To generate and e-file a tax return, follow these steps:

- Click on the "Filing Management" section of the dashboard.

- Click on the "Generate Return" button.

- Select the type of return to generate, such as a corporate or personal return.

- The system will generate the return based on the tax settings and data uploaded.

- Review and edit the return as necessary.

- Click on the "E-File" button to submit the return to the relevant tax authority.

Step 7: Managing and Tracking Tax Filings

To manage and track tax filings, follow these steps:

- Click on the "Filing Management" section of the dashboard.

- View the list of previously submitted returns.

- Track the status of each return, including submitted, received, and approved or rejected.

- Review and edit previously submitted returns as necessary.

By following these steps, you will be able to effectively use Taxstick - Tax Filing Management System (MERN) to streamline your tax filing process and ensure compliance with tax laws.

Note: This tutorial assumes a basic understanding of the MERN architecture and technology. If you are not familiar with these concepts, please consult with a developer or consult the relevant documentation before attempting to use Taxstick - Tax Filing Management System (MERN).

Connection Settings

Connection string:

connectionString = "mongodb://localhost:27017";Database Name

Name of the MongoDB database where Taxstick - Tax Filing Management System (MERN) data will be stored:

dbName = "Taxstick_MERN";Taxstick_MERN Cluster

Name of the cluster for Taxstick - Tax Filing Management System (MERN) in Atlas:

clusterName = "myClusterName";Application Name

The name that will be used for this application in Atlas:

appName = "My Taxstick_MERN Application";JWT Secret

A secret for signing and verifying JSON Web Tokens (JWT) generated by Taxstick - Tax Filing Management System (MERN):

jwtSecret = "YOUR_JWT_SECRET_KEY_HERE";PORT

The port that will be used to start Taxstick - Tax Filing Management System (MERN) server:

port = 3001;Password Hashing Cost

A value that specifies the computation cost for generating passwords for Taxstick - Tax Filing Management System (MERN):

cost = 10;Here are all the features of the Taxstick - Tax Filing Management System (MERN):

- Dynamic Frontend: A customizable and dynamic frontend for ease of use.

- Eye-catching design: A visually appealing design that makes the system user-friendly.

- Responsive with any device: Supports responsive design, ensuring usability on any device ( desktop, tablet, or mobile).

- Admin panel: A centralized control panel for administrators to manage the system.

- Account panel: An account management panel for accounting and financial management.

- User panel: A user-friendly panel for users to manage their profiles and accounts.

- Employee panel: An employee management panel for organizational management.

- Well-documented: All features and functionalities are documented for easy understanding.

- Clean code: The system has clean, organized, and easy-to-maintain code.

Additionally, the system:

- Is a full online-based tax management system, providing a complete tax file management solution.

- Provides a full company website for easy access and management of tax files.

- Offers a quick start guide to help users get started easily.

- Has full documentation available for users.

System Technologies:

- ReactJs

- NextJs

- NodeJs

- ExpressJs

- MongoDB

- Tailwind CSS

- React-Bootstrap

- Ant Design

- Tawk.to Massage Service

$99.00

There are no reviews yet.